If you want to invest in stock market then you should know about Wipro. In this article we will discuss about the Wipro share price target 2024, 2025, 2027, 2030 & 2040. Before that, let’s know about Wipro.

Overview – Wipro Limited

Wipro was founded in 1945 by Mohamed Hasham Premji, the company initially focused on producing vegetable and refined oils under the name “Western India Vegetable Products Limited” (Wipro stands for Western India Palm Refined Oils). It is headquartered in Bengaluru, India. The company ventured into manufacturing mini computers in collaboration with an American firm in the 1980s.

Today Wipro is a leading global player in IT industry. Now, it offers a various services as following:

Computer Hardware and Software Services: Wipro provides a range of hardware and software solutions.

Consulting: The company offers expert consulting services, helping businesses strategize, optimize processes, and helps in achieving their goals.

Business Process Outsourcing (BPO): Wipro excels in BPO services, handling tasks like customer support, back-office operations, and data management for its clients.

Wipro Share Price Target 2024

In 2022, the revenue was ₹81372 crore which has been increased to ₹92752 crore in 2023. Expenses in 2022 were ₹66237 crore which increased to ₹77981 crore in 2023. EBITA in 2022 was ₹18752 crore, which turned into ₹19112 crore in 2023.

EBIT has also been increased to ₹15773 crore in 2023, which was ₹15671 crore in 2022.

| Year | Wipro Share Price Target 2024 |

|---|---|

| 2024 | ₹440 – ₹515 |

Analysts are predicting the Wipro share price for 2024 between ₹440 to ₹515.

Wipro Share Price Target 2025

Net profit in 2022 was ₹12242 crore which turned into ₹11365 crore in 2023 but profit before tax in 2022 was ₹15141 crore which increased to ₹14766 crore in 2023. Debt to equity 0.25 as per 2023 which was 0.23 in 2022.

| Year | Wipro Share Price Target 2025 |

|---|---|

| 2025 | ₹525 – ₹600 |

Wipro share price target for 2025 is expected to be between ₹525 – ₹600.

Wipro Share Price Target 2027

If we talk about the financial ratios, then operating profit margin and net profit margin has been decreased to 21.11% and 12.55% respectively. Dividend per share is 1.00 in 2023. Wipro book value is 141. Closing cash balance in 2023 is 9186 crore.

| Year | Wipro Share Price Target 2027 |

|---|---|

| 2027 | ₹675 – ₹740 |

Analysts foresee a bullish trend for wipro share price after considering the strengths & profitability, with price ranging from ₹675 – ₹740.

Wipro Share Price Target 2030

Total assets of Wipro are increased to ₹66111 crore in 2023, which were ₹107504 crore in 2022. Current liabilities has been decreased to ₹26775 crore but non-current liabilities are increased to ₹12632 crore in 2023. Change in working capital is ₹(-1455) crore.

| Year | Wipro Share Price Target 2030 |

|---|---|

| 2030 | ₹835 – ₹890 |

Analysts are predicting wipro share price target for 2030 between ₹835 – ₹890.

Also Read: ICICI Direct App Review

Wipro Share Price Target 2040

Cash flow from operating activities has been increased to ₹13059 crore but cash flow from financing and investing activities is negative. Investing activities (-8168 crore) and Financing activities (-6087 crore) as per 2023. Net change in cash is (-1197 crore).

| Year | Wipro Share Price Target 2040 |

|---|---|

| 2040 | ₹1290 – ₹1350 |

Wipro share price target for 2040 is expected to be ₹1290 as minimum and ₹1350 as maximum.

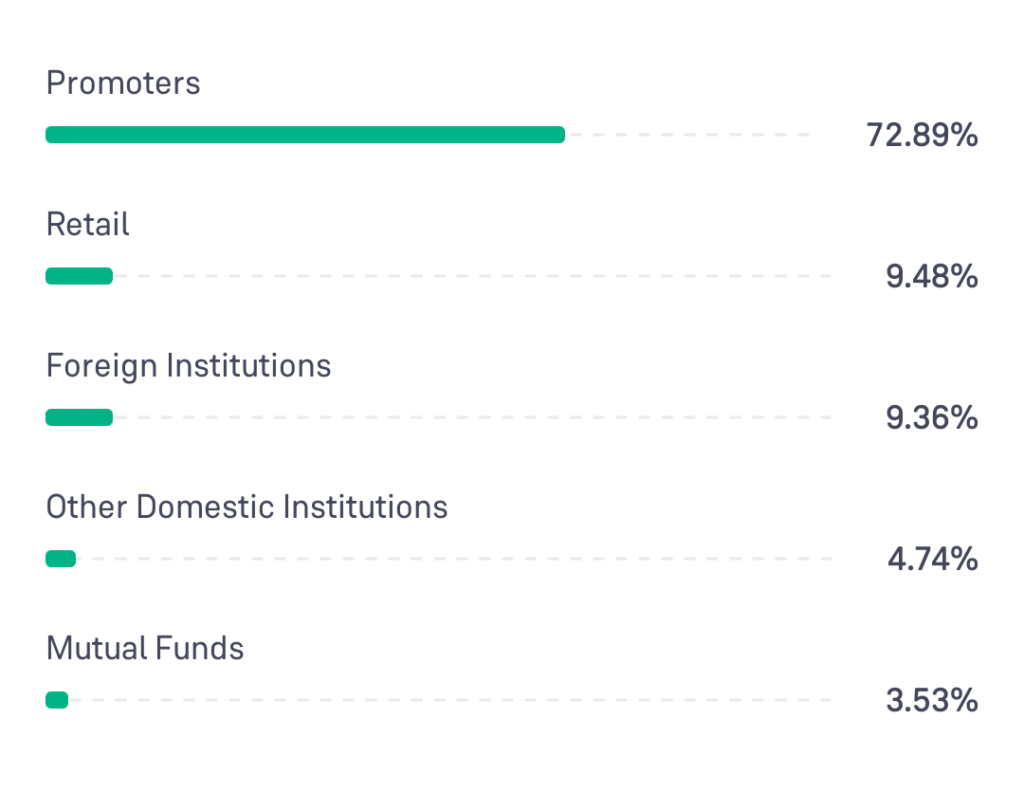

Wipro Shareholding Pattern

• Wipro promoters holding ratio is 72.89%.

• It’s retail holding is 9.48%.

• Foreign Institutions – 9.36%.

• Other Domestic Institutions – 4.74%.

• Mutual Funds – 3.53%.

Wipro Ltd. Profit & Loss

| PARTICULARS | MAR 2021 (In CR.) | MAR 2022 (In CR.) | MAR 2023 (In CR.) |

| Net Sales (Cr.) | 50,299.40 | 59,574.40 | 67,753.40 |

| Total Expenditure (Cr.) | 38,553.90 | 47,266.80 | 56,087.80 |

| Operating Profit (Cr.) | 11,745 | 12,307.60 | 11,665.60 |

| Other Income (Cr.) | 2,691.20 | 4,809.70 | 2,824.30 |

| Interest (Cr.) | 402.60 | 367.40 | 628.90 |

| Depreciation (Cr.) | 1,349.30 | 1,485.70 | 1,592.10 |

| Exceptional Items (Cr.) | 0 | 0 | 0 |

| Profit Before Tax (Cr.) | 12,684.80 | 15,264.20 | 12,268.90 |

| Provision for Tax (Cr.) | 2,623.90 | 3,128.90 | 3,092.20 |

| Net Profit (Cr.) | 10,060.90 | 12,135.30 | 9,176.70 |

| Adjusted EPS (Rs.) | 18.36 | 22.14 | 16.72 |

Wipro Ltd. Balance Sheet

| Equity and Liabilities | MAR 2021 (In CR.) | MAR 2022 (In CR.) | MAR 2023 (In CR.) |

|---|---|---|---|

| Share Capital (Cr.) | 1,095.80 | 1,096.40 | 1,097.60 |

| Total Reserves (Cr.) | 44,145.80 | 53,254.30 | 61,664.70 |

| Borrowings (Cr.) | 14.10 | 5.70 | 0 |

| Other Non-Current Liabilities (Cr.) | 2,300.80 | 2,799.40 | 3,635.70 |

| Current Liabilities (Cr.) | 18,132.40 | 23,173.70 | 18,842.80 |

| Total Liabilities (Cr.) | 65,688.90 | 80,329.50 | 85,240.80 |

| Assests | MAR 2021 (In CR.) | MAR 2022 (In CR.) | MAR 2023 (In CR.) |

|---|---|---|---|

| Net Block (Cr.) | 7,288.10 | 8,037.70 | 8,824.70 |

| Capital Work-in-Progress (Cr.) | 1,848.00 | 1,584.50 | 603.80 |

| Intangible Work-in-Progress (Cr.) | 0 | 0 | 0 |

| Investments (Cr.) | 8,206.70 | 16,557.20 | 19,372.80 |

| Loans & Advances (Cr.) | 2,336.50 | 1,577.60 | 1,780.80 |

| Other Non-Current Assets (Cr.) | 630.10 | 800.30 | 680.90 |

| Current Assets (Cr.) | 45,379.50 | 51,772.20 | 53,977.80 |

| Total Assets (Cr.) | 65,688.90 | 80,329.50 | 85,240.80 |

Advantages & Disadvantages Of Investing In Wipro

Before investing or buying any share, you must know it’s advantages and disadvantages. So let’s discuss:

Advantages

• Wipro is a leading player with strong reputation.

• Wipro operates in more than 66 countries, which provides access to a wider customer base and potential for growth in new markets.

• Good cash conversion ratio.

• Wipro maintained a healthy financial position with consistent profitability, which makes it a reliable investment option.

• Wipro is debt free.

Disadvantages

• Profit is decreasing from last years.

• Revenue amount is also in a declining state.

Conclusion

As per our research, wipro share price is indicating both positive and negative sides. But as the wipro is a leading global player & profitable, so it can generate good returns on the investments but market conditions can affect it’s share price. Do your own research before investing and consult with a financial advisor/ consultant.

1. What is wipro’s share price target for 2024?

Analysts are predicting the Wipro share price for 2024 between ₹440 to ₹515.

2. What is wipro’s share price target for 2025?

Wipro share price target for 2025 is expected to be between ₹525 – ₹600.

3. What is wipro’s share price target for 2027?

Analysts are predicting wipro share price ranging from ₹675 – ₹740 in 2027.

4. What is wipro’s share price target for 2030?

Analysts are predicting wipro share price target for 2030 between ₹835 – ₹890.

5. What is wipro’s share price target for 2040?

Wipro share price target for 2040 is expected to be ₹1290- ₹1350.

6. Who is the CEO of Wipro?

Srini Pallia is the CEO of Wipro Ltd.

Also Read: YES Bank Share Price Target

Disclaimer: We are not SEBI-registered. The information given here is only for educational purposes. Share market is risky, so please research before investing.