If you want to invest in share market and finding a best share then you should know about Titan company share. In this article we will discuss the Titan share price target for 2024, 2025, 2027, 2030 & 2040. But before that let’s know about Titan Company Ltd.

About Titan Company Limited

Titan was established in 1984 as a joint venture between the TATA Group. It have more than 2000 stores and 16 different brands. Titan is one of the leading company in selling watches, jewellery and eyewear.

In 1992, Titan entered into a joint venture with the Timesc, which enhanced it’s market presence & popularity.

Titan Company was listed on September 24, 2004 and it is listed on both NSE(National Stock Exchange) and BSE (Bombay Stock Exchange). Let’s discuss the share price target of Titan Company Limited.

Titan Share price Target 2024

| Months | Target Price |

| January | 3633.41 |

| February | 3592.27 |

| March | 3592.27 |

| April | 3571.88 |

| May | 3633.11 |

| June | 3633.28 |

| July | 3633.68 |

| August | 3886.64 |

| September | 3887.24 |

| October | 4297.03 |

| November | 4297.22 |

| December | 4297.52 |

Titan Company Limited Share price Target 2025

| Months | Target Price |

| January | 4553.11 |

| February | 4593.86 |

| March | 4552.97 |

| April | 4532.25 |

| May | 4532.21 |

| June | 4531.96 |

| July | 4531.97 |

| August | 4531.78 |

| September | 4532.02 |

| October | 4532.1 |

| November | 4532.45 |

| December | 4532.5 |

Titan Company Limited Share price Target 2027

| Months | Target Price |

| January | 5191.34 |

| February | 5231.83 |

| March | 5191.41 |

| April | 5171.17 |

| May | 5171.04 |

| June | 5171.25 |

| July | 5171.47 |

| August | 5171.41 |

| September | 5171.58 |

| October | 5171.78 |

| November | 5171.85 |

| December | 5172.24 |

Titan Company Limited Share price Target 2030

| Months | Target Price |

| January | 6272.22 |

| February | 6312.95 |

| March | 6272.18 |

| April | 6251.43 |

| May | 6251.44 |

| June | 6251.39 |

| July | 6251.62 |

| August | 6251.45 |

| September | 6251.3 |

| October | 6251.01 |

| November | 6251.08 |

| December | 6251.06 |

Titan Company Limited Share Price Target 2040

| Year | Titan Company Limited Share Price Target 2040 |

|---|---|

| 2040 | ₹10,305.56 – ₹10725.35 |

Also Read: Yes Bank Share Price Target

Titan Company- Financial Analysis

| Fiscal Period | 2024 | 2023 | 2022 | 2021 |

|---|---|---|---|---|

| Period End Date | Mar 24 | Mar 23 | Mar 22 | Mar 21 |

| Revenue | 51,084.00 | 40,575.00 | 28,799.00 | 21,644.00 |

| Total Revenue | 51,084.00 | 40,575.00 | 28,799.00 | 21,644.00 |

| Cost of Revenue Total | 39,432.00 | 30,470.00 | 21,730.00 | 16,477.00 |

| Gross Profit | 11,652.00 | 10,105.00 | 7,069.00 | 5,167.00 |

| Selling/ General/ Admin Expenses Total | 3,012.00 | 4,587.00 | 3,233.00 | 3,027.00 |

| Depreciation/ Amortization | 584.00 | 441.00 | 399.00 | 376.00 |

| Other Operating Expenses Total | 3,348.00 | 610.00 | 455.00 | 362.00 |

| Total Operating Expense | 46,376.00 | 36,108.00 | 25,889.00 | 20,212.00 |

| Operating Income | 4,708.00 | 4,467.00 | 2,910.00 | 1,432.00 |

| Interest Inc( Exp) Net- Non- Op Total | -6,180.00 | -710.00 | -540.00 | -1,130.00 |

| Other Net | 533.00 | 54.00 | 51.00 | 14.00 |

| Net Income Before Taxes | 4,623.00 | 4,447.00 | 2,904.00 | 1,327.00 |

| Provision for Income Taxes | 1,127.00 | 1,173.00 | 706.00 | 353.00 |

| Net Income After Taxes | 3,496.00 | 3,274.00 | 2,198.00 | 974.00 |

| Minority Interest | 0.00 | -24.00 | -25.00 | -1.00 |

| Net Income Before Extra Items | 3,496.00 | 3,250.00 | 2,173.00 | 973.00 |

| Net Income | 3,496.00 | 3,250.00 | 2,173.00 | 973.00 |

| Income Availableto Com Excl Extra Ord | 3,496.00 | 3,250.00 | 2,173.00 | 973.00 |

| Income Availableto Com Incl Extra Ord | 3,496.00 | 3,250.00 | 2,173.00 | 973.00 |

| Diluted Net Income | 3,496.00 | 3,250.00 | 2,173.00 | 973.00 |

| Diluted Weighted Average Shares | 88.78 | 88.78 | 88.78 | 88.78 |

| Diluted EPS Excluding Extra Ord Items | 39.38 | 36.61 | 24.48 | 10.96 |

| DPS- Common Stock Primary Issue | 11.00 | 10.00 | 7.50 | 4.00 |

| Diluted Normalized EPS | 39.38 | 36.63 | 25.12 | 10.76 |

| Unusual Expense( Income) | – | 0.00 | 72.00 | -30.00 |

| Gain( Loss)on Sale of Assets | – | -30.00 | -30.00 | -60.00 |

*All figures in crores except per share values

Titan company’s revenue in 2023 is ₹40883 crore, which was ₹29033 crore in 2022. Expenses are also increased to ₹36437 crore in 2023 from ₹26075 (2022).

Similarly, EBITA is also increased to ₹5188 crore from ₹3521 crore(2022). EBIT in 2022 was ₹3122 crore which turned into ₹4747 crore in 2023.

Profit before tax turned to ₹4447 crore in 2023 and net profit is also increased to ₹3274.

Operating profit margin is 12.79% and net profit margin is 8.07% (As per 2023).

Total assets of Titan Company are also increased to ₹27023 crore which were ₹21194 crore in 2022. Total liabilities have also been increased to ₹15119 crore in 2023 which were ₹11861 crore in 2022.

Debt to equity is 0.79 and book value is 133.

Cash flow from operating activities is ₹1370 crore but cash flow from investing activities is negative as (-1814 crore) in 2023.

Further, cash flow from financing activities is ₹457 crore in 2023.

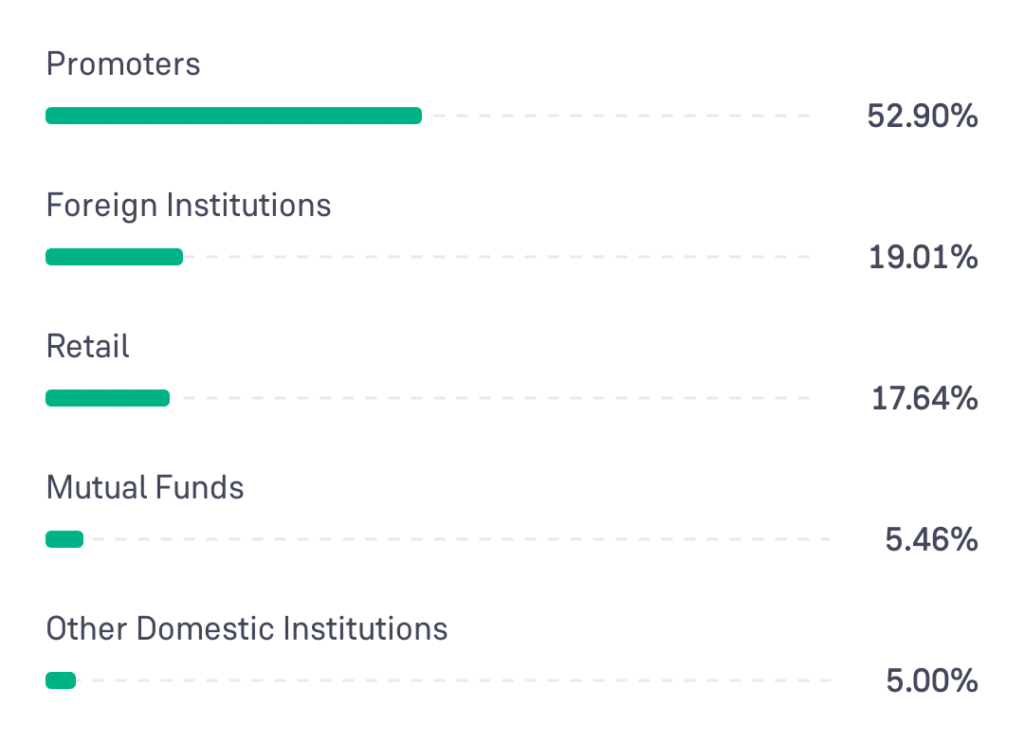

Titan Company Shareholding Pattern

| Shareholders | Share Percentage |

| Promoters | 52.90 percent |

| Retail | 17.64 percent |

| Foreign Institutions | 19.01 percent |

| Mutual Funds | 5.46 percent |

| Other Domestic Institutions | 5.00 percent |

Advantages Of Titan Share

• Titan Company is profitable.

• Higher promoter holding.

• Company’s revenue has also been increased in last three years (25.13%).

• The company have a strong brand reputation in India, built on trust, quality, and innovative designs.

Disadvantages Of Titan Share

• Higher PE ratio (82.25).

• Higher EBITA (53.36).

Conclusion

Titan Company is listed on both NSE (National Stock Exchange) and BSE (Bombay Stock Exchange). Is is the leading company in selling watches, jewellery and eyewear. If we consider the profitability & strengths of Titan Company then it can generate very good profits for investors but market conditions can affect it. So invest carefully, you can also consult with a financial advisor.

FAQs

1. What is the Titan Share Price Target for 2024?

Titan Share Price Target for 2024 is ₹3,633.41 to ₹4,297.52.

2. What is the Titan Share Price Target for 2025?

Titan Share Price Target for 2025 is ₹4553.11 to ₹4593.86.

3. What is the Titan Share Price Target for 2027?

Titan Share Price Target for 2027 is ₹5171.04 to ₹5231.83.

4. What is the Titan Share Price Target for 2030?

Titan Share Price Target for 2030 is ₹6251.06 to ₹6272.22.

5. What is the Titan Share Price Target for 2040?

Titan Share Price Target for 2040 is ₹10,305.56 – ₹10725.35.

6. Who is the CEO of Titan Company Limited?

Mr. C.K. Venkataraman is the CEO of Titan Company Limited.

Disclaimer: We are not SEBI-registered. The information given here is only for educational purposes. Share market is risky, so please research before investing.

Also Read: Wipro Share Price Target