In this article we will discuss Suzlon share price target for 2024, 2025, 2026, 2027 to 2030. But before that let’s know about Suzlon Energy Limited.

About Suzlon

Suzlon Energy Ltd is a leading player in the global wind energy market. It operates in various countries such as Asia, Australia, Europe, Africa and the United States.

Suzlon continuously invests in research and development to enhance the efficiency, affordability and quality of it’s wind turbines. Siemens, ABB India, Havells India are some competitors of Suzlon Energy Limited.

Company Profile

| Parent Organisation | Suzlon Energy Limited |

| MD/CEO | Mr. Vinod Tanti |

| NSE Symbol | SUZLON |

| Founded In | 1995 |

| Market Cap. | Rs. 65,107 crore |

| P/E (TTM) | 94.61 |

| P/B Ratio | 19.21 |

| Industry P/E | 85.42 |

| Debt to Equity | 0.04 |

| ROE | 9.95% |

| EPS (TTM) | 0.51% |

| Div. Yield | 0.00% |

| Book Value | 2.51 |

| Face Value | 2 |

Suzlon Share Price Target (2024)

Share market analysts are predicting that suzlon share price can rise upto ₹63 in 2024 but if we see the revenue, it has been decreased to ₹5990 crore (2023) from ₹6603 (2022) but the company is still profitable which is a positive indicator.

| Month (2024) | Maximum Target |

| January | Rs – |

| February | Rs 55 |

| March | Rs 56 |

| April | Rs 58 |

| May | Rs 60 |

| June | Rs 60 |

| July | Rs 59 |

| August | Rs 59 |

| September | Rs 60.5 |

| October | Rs 60.5 |

| November | Rs 61 |

| December | Rs 63 |

Suzlon Share Price Target (2025)

Suzlon Energy Ltd. share price can rise upto ₹78 in 2025 as the company is growing with slow speed but it have potential to grow more and also it can generate good returns on investments but always keep this in mind that market conditions can affect it’s share price.

| Month (2025) | Maximum Target |

| January | Rs 63 |

| February | Rs 65 |

| March | Rs 68 |

| April | Rs 69 |

| May | Rs 65 |

| June | Rs 70 |

| July | Rs 71 |

| August | Rs 73 |

| September | Rs 75 |

| October | Rs 73 |

| November | Rs 77 |

| December | Rs 78 |

Suzlon Share Price Target 2026

Market cap. in 2023 is ₹65,107 crore and net profit in 2023 is ₹2887 which was negative in 2022 (₹-166.19 crore). If we look at the share price then it have potential to grow more and it can reach around ₹69.38 in 2026.

| Suzlon Share Price Target 2026 | Price |

| January 2026 | ₹66.70 |

| February 2026 | ₹66.75 |

| March 2026 | ₹66.80 |

| April 2026 | ₹66.89 |

| May 2026 | ₹66.90 |

| June 2026 | ₹66.95 |

| July 2026 | ₹67.00 |

| August 2026 | ₹67.40 |

| September 2026 | ₹67.45 |

| October 2026 | ₹68.50 |

| November 2026 | ₹68.50 |

| December 2026 | ₹69.38 |

| Suzlon Share Price Target 2026 | ₹69.38 |

Suzlon Share Price Target 2027

EBITA in 2023 is ₹3572 crore which was ₹994 crore in 2022. So, if we consider the profitability then Suzlon’s share price can rise more higher in future. Experts are predicting share price can reach around ₹77.28 in 2027.

| Suzlon Share Price Target 2027 | ₹77.28 |

Suzlon Power Share Price Target 2030

Operating profit margin in 2023 is 14.28%, net profit margin is 2.89%. If we look at the liabilities, these are also been decreased to ₹4424 in 2023 which were ₹10036 in 2022. If we talk about it’s share price then it can rise around ₹110.78 in 2030.

| Suzlon Power Share Price Target 2030 | Price |

| January 2030 | ₹81.20 |

| February 2030 | ₹83.30 |

| March 2030 | ₹85.50 |

| April 2030 | ₹88.70 |

| May 2030 | ₹89.75 |

| June 2030 | ₹91.90 |

| July 2030 | ₹104.00 |

| August 2030 | ₹104.40 |

| September 2030 | ₹105.70 |

| October 2030 | ₹106.80 |

| November 2030 | ₹107.89 |

| December 230 | ₹110.78 |

| Suzlon Share Price Target 2030 | ₹110.78 |

Also Read: IREDA Share Price Target 2024, 2025, 2026, 2027, 2030, 2040

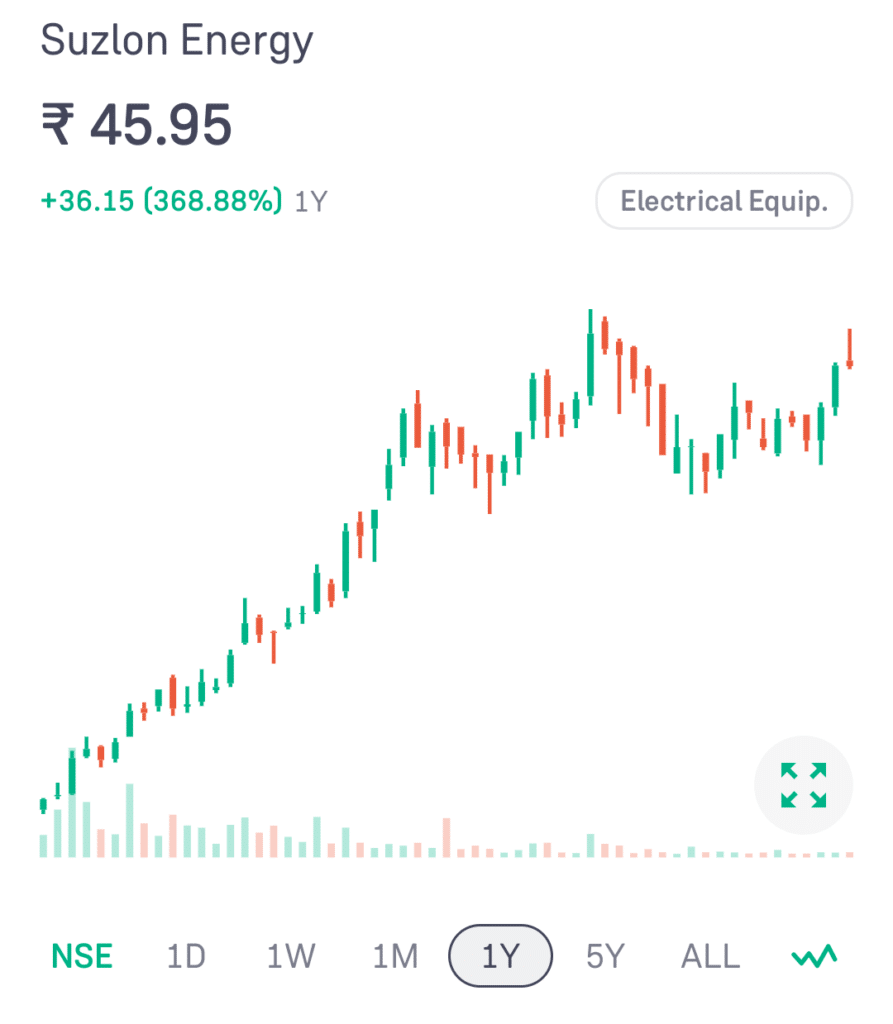

Suzlon Energy Ltd. Share Price Chart

Suzlon Energy Ltd. Profit & Loss

| Fiscal Period | 2024 | 2023 | 2022 | 2021 |

|---|---|---|---|---|

| Period End Date | Mar 24 | Mar 23 | Mar 22 | Mar 21 |

| Revenue | 6,529.09 | 5,970.53 | 6,581.78 | 3,345.72 |

| Total Revenue | 6,529.09 | 5,970.53 | 6,581.78 | 3,345.72 |

| Costof Revenue Total | 4,685.03 | 4,450.85 | 4,940.19 | 2,146.80 |

| Gross Profit | 1,844.06 | 1,519.68 | 1,641.59 | 1,198.92 |

| Depreciation/ Amortization | 189.60 | 258.03 | 258.21 | 256.35 |

| Unusual Expense( Income) | 53.89 | -2,664.94 | -65.63 | 2.53 |

| Other Operating Expenses Total | 805.87 | 85.92 | 85.52 | -697.23 |

| Total Operating Expense | 5,734.39 | 2,725.12 | 5,919.69 | 2,242.62 |

| Operating Income | 794.70 | 3,245.41 | 662.09 | 1,103.10 |

| Interest Inc( Exp) Net- Non- Op Total | -1,736.30 | -3,694.30 | -6,187.60 | -9,628.50 |

| Other Net | 38.42 | -38.55 | -32.40 | -32.87 |

| Net Income Before Taxes | 659.49 | 2,891.71 | 0.40 | 104.97 |

| Provisionfor Income Taxes | -0.86 | 4.42 | 166.59 | 4.63 |

| Net Income After Taxes | 660.35 | 2,887.29 | -166.19 | 100.34 |

| Minority Interest | 0.00 | -38.28 | -23.04 | 0.59 |

| Equity In Affiliates | 0.00 | 0.00 | -103.60 | 32.50 |

| Net Income Before Extra Items | 660.35 | 2,849.01 | -199.59 | 104.18 |

| Net Income | 660.35 | 2,849.01 | -199.59 | 104.18 |

| Income Availableto Com Excl Extra Ord | 660.35 | 2,849.01 | -199.59 | 104.18 |

| Income Availableto Com Incl Extra Ord | 660.35 | 2,849.01 | -199.59 | 104.18 |

| Diluted Net Income | 660.35 | 2,849.01 | -199.59 | 104.18 |

| Diluted Weighted Average Shares | 1,320.70 | 1,077.53 | 972.21 | 825.71 |

| Diluted EPS Excluding Extra Ord Items | 0.50 | 2.64 | -0.21 | 0.13 |

| Diluted Normalized EPS | 0.53 | 0.12 | -0.23 | 0.13 |

| Selling/ General/ Admin Expenses Total | – | 586.38 | 695.64 | 526.18 |

| Research Development | – | 72.30 | 41.30 | 59.60 |

| Interest Exp( Inc) Net- Operating Total | – | 16.50 | 16.30 | 20.30 |

| Gain( Loss)on Saleof Assets | – | 542.80 | -105.30 | -24.10 |

*All figures in crores except per share values

Also Read: HDFC Bank Share Price Target 2024,2025,2026 to 2030

Suzlon Energy Ltd. Assets & Liabilities

| Particulars | 2023 (in Cr.) | 2022 (in Cr.) |

| Revenue | 5990 | 6603 |

| EBITA | 3572 | 994 |

| Net Profit | 2887 | -166.19 |

| Total Assets | 5523 | 6474 |

| – Current Assets | 4142 | 5019 |

| – Non-current Assets | 1381 | 1455 |

| Total Liabilities | 4424 | 10036 |

| – Current Liabilities | 2700 | 4234 |

| – Non-current Liabilities | 1723 | 5802 |

- Total assets of the company are ₹5523 crore in which current assets are ₹4142 crore & non-current assets are ₹1381 crore.

- Total liabilities of Suzlon Energy Ltd are ₹4424 crore in which current liabilities are ₹2700 crore & non-current liabilities are ₹1723 crore.

- Cash flow from operating activities is ₹466 crore, cash flow from the Investing activities is ₹84 crore & cash flow from financing activities is ₹-684 crore respectively.

- Net change in cash is ₹-133 crore & closing cash balance is ₹367 crore.

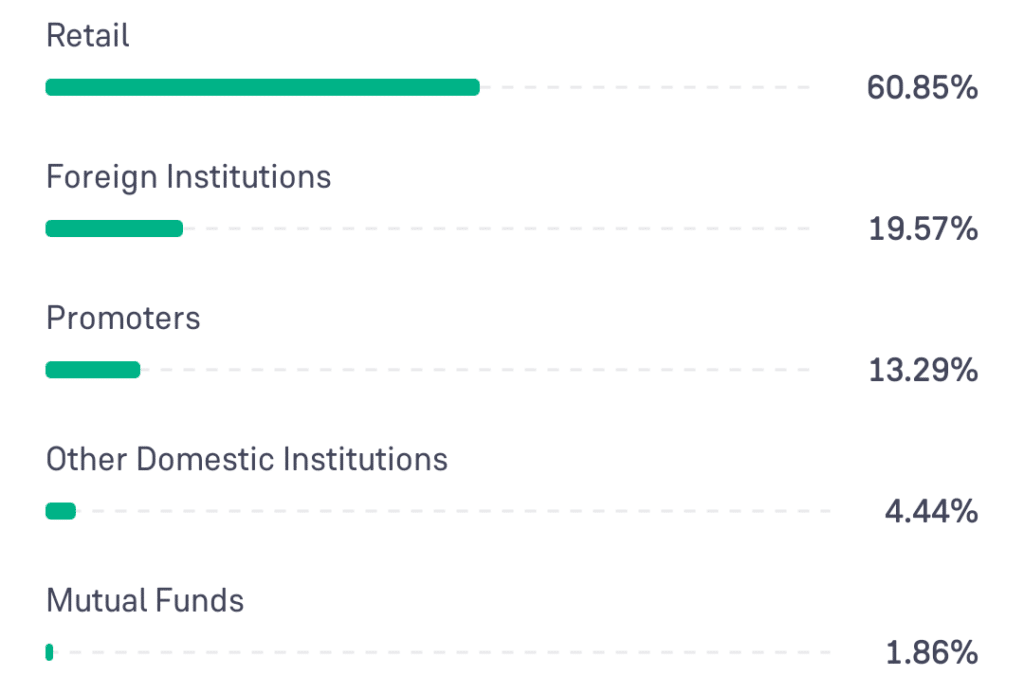

Suzlon Energy Ltd. Shareholding Pattern

Conclusion

Suzlon Energy Ltd. is a good company for investment. If we consider the strengths of this company then it have potential to grow more, thus it can generate good returns but exceptions are there i.e. market conditions may affect it’s share price. It is advised to consult with a financial advisor or do your deep research before investing in stock market.

FAQs

What is the Suzlon Share Price Target in 2024?

Suzlon share price can rise upto ₹63 in 2024.

What is the Suzlon Share Price Target in 2025?

Suzlon Energy Ltd. share price can rise upto ₹78 in 2025.

What is the Suzlon Share Price Target in 2027?

Experts are predicting share price can reach around ₹77.28 in 2027.

What is the Suzlon Share Price Target in 2030?

Suzlon share price can rise around ₹110.78 in 2030.

Who is the CEO of Suzlon Energy Ltd.?

Mr. Vinod Tanti is the CEO of Suzlon Energy Ltd.

Also Read: IRFC Share Price Target

Disclaimer: We are not SEBI-registered. The information given here is only for educational purposes. Share market is risky, so please research before investing.