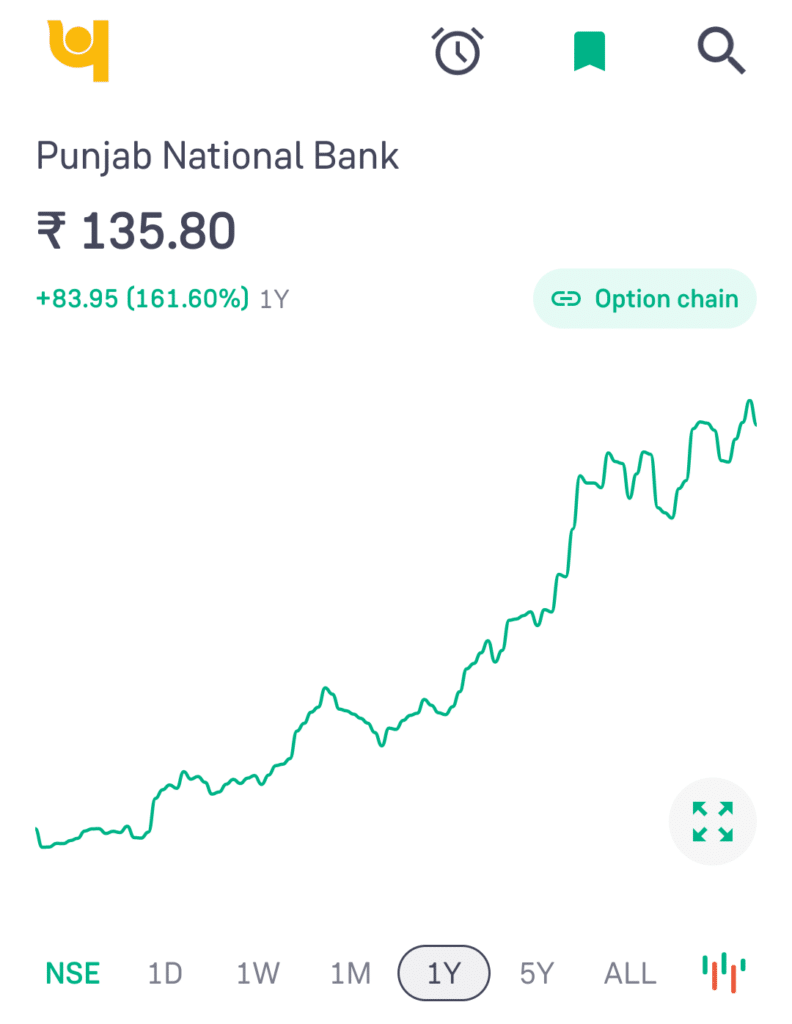

If you are searching for the best share for investment then you should know about PNB. In this blog post, we will discuss about the PNB share price target 2024, 2025, 2027, 2030 to 2035.

After reading this article, you will be able to decide whether you should invest in PNB share or not. But before discussing the PNB share price target, let’s understand about PNB.

About PNB

PNB (Punjab National Bank) was established in April 12,1895. PNB is a leading public sector bank in India with vast network of over 12000+ branches and 13000+ ATMs.

PNB offers a variety of financial products to both individuals and businesses which includes savings accounts, loans, investments and more. PNB prioritizes digitalization with it’s user-friendly mobile app and internet banking platforms.

| Category | Details |

| Parent Organization | Punjab National Bank |

| Founded In | 1895 |

| Type | Public |

| CEO | Mr. Atul Goel |

| Market Cap. | ₹1,51,953 Cr. |

| ROE | 7.59% |

| P/E Ratio (TTM) | 19.89% |

| EPS (TTM) | 6.91% |

| P/B Ratio | 1.49% |

| Div. Yield | 0.46% |

| Industry P/E | 14.51% |

| Book Value | 91.01 |

| Face Value | 2 |

| Net Profit (2023) | ₹3,357 Cr. |

| Website | https://www.pnbindia.in/ |

PNB Share Price Target 2024

PNB is a public sector bank, thus offers a sense of security.

Total revenue in 2022 was ₹25,723 crore which increased to ₹29,961 crore. Cash flow from operating activities in 2022 was ₹20,031 crore which turned into ₹22,592 crore in 2023.

| Year | PNB Share Price Target 2024 |

|---|---|

| 2024 | ₹127.55 – ₹145.67 |

PNB share price target for 2024 is between ₹127.55 to ₹145.67.

PNB Share Price Target 2025

If we talk about financial ratio, operating profit margin in 2022 was 63.46% which turned into 75.44% in 2023.

| Year | PNB Share Price Target 2025 |

|---|---|

| 2025 | ₹145.35 – ₹176.78 |

Analysts foresee a bullish trend for PNB in 2025 with price ranging from ₹145.35 to ₹176.78.

PNB Share Price Target 2026

Net profit margin in 2022 was 5.03% which became 3.85% in 2023. Earning per share (Diluted) was 3.52 which became 3.04 in 2023.

| Year | PNB Share Price Target 2026 |

|---|---|

| 2026 | ₹178.75 – ₹206.36 |

Analysts are predicting PNB share price for 2026 between ₹178.75 to ₹206.36.

PNB Share Price Target 2027

Current assets in 2022 were ₹1,54,462 crore which became ₹1,79,609 crore in 2023. PNB book value is 85 in 2023.

Current liabilities in 2022 were ₹11,54,235 crore which became ₹12,90,348 crore in 2023.

| Year | PNB Share Price Target 2027 |

|---|---|

| 2027 | ₹207.95 – ₹236.47 |

As per market experts, PNB share price can rise upto ₹207.95 and ₹236.47 is expected to be the minimum price.

PNB Share Price Target 2030

Cash flow from investing activities in 2022 was ₹-1204.35 crore which became ₹-732.46 crore in 2023 whereas cash flow from financing activities in 2022 was ₹2032 crore which turned into ₹1275 crore in 2023.

| Year | PNB Share Price Target 2030 |

|---|---|

| 2030 | ₹334.85 – ₹399.68 |

Analysts expects PNB share price target for 2030 ₹334.85 as minimum and ₹399.68 as maximum.

PNB Share Price Target 2035

EBITA (Earning before interest, taxes and amortization) was ₹5721 crore in 2022 which turned into ₹6056 crore in 2023 and net profit for the year 2022 was ₹3908 crore which became ₹3357 in 2023.

| Year | PNB Share Price Target 2035 |

|---|---|

| 2035 | ₹545.89 – ₹685.27 |

If we consider strengths & profitability then PNB share price can rise upto ₹545.89 in 2035 and ₹685.27 is expected as minimum price.

Also Read: Vedanta Ltd (VEDL) Share Price Target 2024, 2025, 2026 to 2030

PNB Shareholding Pattern

| Category | Details |

| Promoters | 73.15% |

| Retail | 9.67 |

| Other Domestic Institutions | 8.94% |

| Foreign Institutions | 4.82% |

| Mutual Funds | 3.43% |

Punjab National Bank Profit & Loss

PNB profit & loss account for year 2022 and 2023 is listed below:

| Fiscal Period | 2023 | 2022 |

|---|---|---|

| Period End Date | Mar 23 | Mar 22 |

| Interest Income Bank | 86,845.29 | 76,241.83 |

| Total Interest Expense | 51,816.99 | 46,823.08 |

| Net Interest Income | 35,028.30 | 29,418.75 |

| Loan Loss Provision | 15,828.44 | 14,123.13 |

| Net Interest Inc After Loan Loss Prov | 19,199.86 | 15,295.62 |

| Non- Interest Income Bank | 12,239.59 | 12,097.66 |

| Non- Interest Expense Bank | -26,578.02 | -22,798.82 |

| Net Income Before Taxes | 4,861.43 | 4,594.46 |

| Provisionfor Income Taxes | 1,792.08 | 918.50 |

| Net Income After Taxes | 3,069.35 | 3,675.96 |

| Minority Interest | -10.33 | -46.85 |

| Equity In Affiliates | 2,894.40 | 2,316.30 |

| Net Income Before Extra Items | 3,348.46 | 3,860.74 |

| Net Income | 3,348.46 | 3,860.74 |

| Total Adjustmentsto Net Income | -0.10 | – |

| Income Availableto Com Excl Extra Ord | 3,348.45 | 3,860.74 |

| Income Availableto Com Incl Extra Ord | 3,348.45 | 3,860.74 |

| Diluted Net Income | 3,348.45 | 3,860.74 |

| Diluted Weighted Average Shares | 1,101.10 | 1,094.67 |

| Diluted EPS Excluding Extra Ord Items | 3.04 | 3.53 |

| DPS- Common Stock Primary Issue | 0.65 | 0.64 |

| Diluted Normalized EPS | 4.17 | 3.94 |

PNB Balance Sheet and Profit & Loss in detail.

Also Read: NTPC Share Price Target 2024, 2026, 2027, 2030, 2040

Advantages & Disadvantages of PNB

Considering both advantages and disadvantages is important before investing in market.

Advantages

• As a public sector bank, PNB offers a layer of security with the backing of the Indian government.

• PNB is one of the leading bank with 12000+ branches and 13000+ ATMs.

• Strong promoter holding (73.15%).

• Market cap of PNB is ₹1,51,953 crore and ROE is 7.59%, which is a positive indicator.

Disadvantages

• Limited retail Investor Participation (9.67%).

• P/E Ratio is (19.89%), being higher than the industry average (14.51%), which may result in lower returns.

Conclusion

We have discussed PNB share price target 2024, 2025, 2027, 2030 to 2035. PNB is one of the leading bank in India with strong government backing. If we consider strengths & profitability of PNB, then it can generate profits but market conditions can affect PNB share price.

FAQs

Who is PNB (Punjab National Bank) CEO?

Mr. Atul Goel is CEO of PNB.

What is PNB share price target in 2024?

PNB share price target for 2024 is between ₹127.55 to ₹145.67.

What is PNB share price target in 2025?

Analysts foresee a bullish trend for PNB in 2025 with price ranging from ₹145.35 to ₹176.78.

What is PNB share price target in 2027?

As per market experts, PNB share price can rise upto ₹207.95 and ₹236.47 is expected to be the minimum price.

What is PNB share price target in 2030?

Analysts expects PNB share price target for 2030 ₹334.85 as minimum and ₹399.68 as maximum.

Is PNB a public sector bank?

Yes, PNB is a public sector bank which was established in 1895.

Does PNB pay dividends?

Yes, PNB declared a dividend of ₹0.65 per share for the year 2023.

Is it good to buy PNB shares now?

PNB possesses a healthy Return on Equity (ROE) of 7.59%, indicating efficient use of capital. It also offers a decent dividend yield of 0.46%. If we consider the profitability of PNB then it can generate good profits in future but also keep this in mind that market conditions can affect PNB share price.

If you have any question, then comment below, we will try to solve your query.

Disclaimer: We are not SEBI-registered. The information given here is only for educational purposes. Share market is risky, so please research before investing.