In this article, we will discuss the Jio Financial Share Price Target 2024, 2025, 2027, 2030 & 2040. But before that let’s know about Jio Financial Services Ltd.

About Jio Financial Services Ltd.

Jio Financial Services Ltd. (JFSL) is a leading Indian financial services company. It was established in 1999 and was listed on Indian stock exchanges in August 2023. It is headquartered in Mumbai, Maharashtra and founded by Mukesh Ambani.

Services Offered By Jio Financial Services

• Jio Financial facilitates digital payments and other payment related services.

• The company acts as an intermediary between insurance providers and consumers.

Company Profile

| Name | Jio Finance |

| Company type | Public |

| Traded as | BSE: 543940 NSE: JIOFIN |

| ISIN | INE758E01017 |

| Founder | Mukesh Ambani |

| Headquarters | Mumbai, Maharashtra |

| Website | www.jfs.in |

Jio Finance Share Price Target 2024

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 305 | 321 |

| February | 234 | 323 |

| March | 313 | 332 |

| April | 317 | 337 |

| May | 321 | 342 |

| June | 324 | 347 |

| July | 339 | 352 |

| August | 333 | 357 |

| September | 345 | 362 |

| October | 346 | 367 |

| November | 351 | 373 |

| December | 356 | 377 |

The company deals in personal loans, educational loans, home loans etc., which increases the profitability.

Jio Finance Share Price Target 2025

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 345 | 365 |

| February | 360 | 367 |

| March | 355 | 373 |

| April | 354 | 377 |

| May | 362 | 383 |

| June | 365 | 387 |

| July | 372 | 398 |

| August | 377 | 399 |

| September | 383 | 405 |

| October | 385 | 405 |

| November | 390 | 410 |

| December | 395 | 415 |

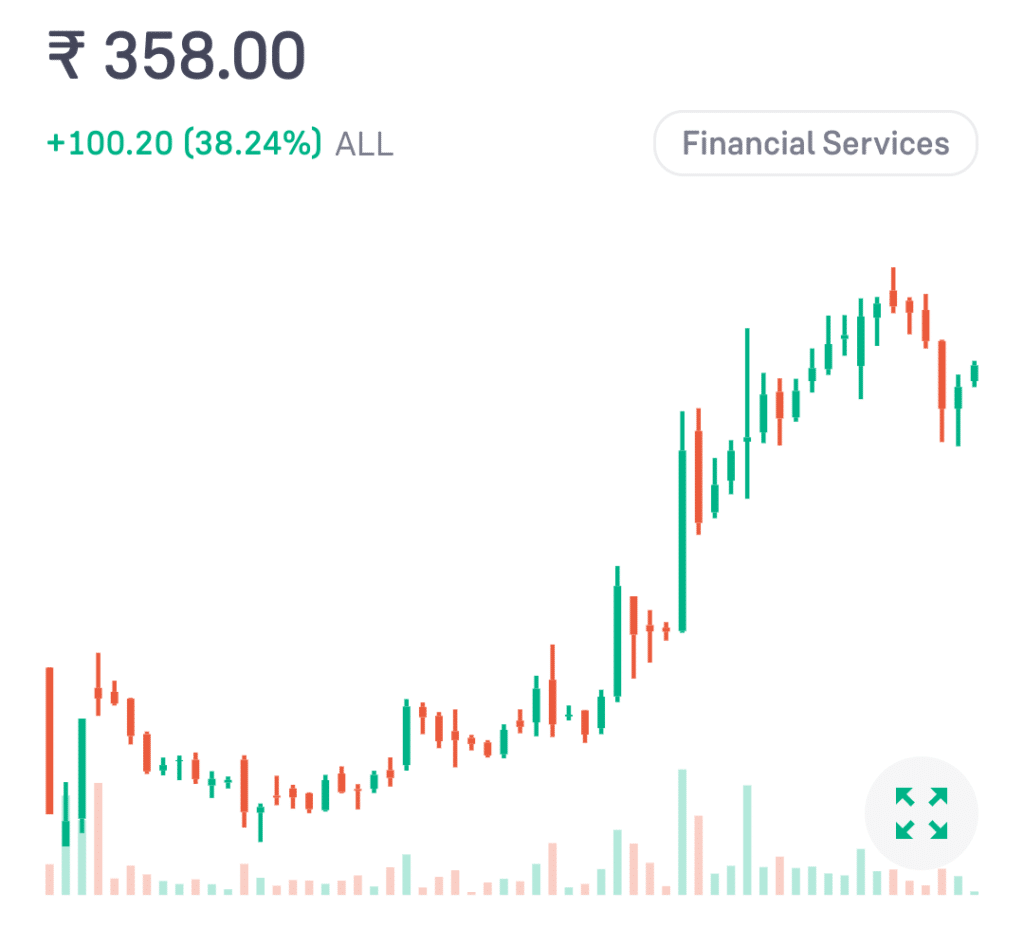

Jio Financial share price is increasing fastly, as on 8th December 2023 it was ₹250.15 but today on (21/05/2024) the price is ₹357.40. So, we can expect a good return in future but market conditions can affect it’s share price.

Jio Finance Share Price Target 2027

| Year | Jio Financial Share Price Target 2027 |

| Minimum | 415 |

| Maximum | 445 |

The company has also started the net banking process. In this, the customers will be able to access all the banking facilities i.e. they can open/close their banking accounts, apply for loan and they can also deposit money in their bank account. If we talk about the share price target for 2027, ₹415 is expected as the minimum and ₹445 as maximum price.

Jio Finance Share Price Target 2030

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 454 | 487 |

| February | 459 | 499 |

| March | 473 | 503 |

| April | 483 | 515 |

| May | 494 | 519 |

| June | 502 | 531 |

| July | 511 | 544 |

| August | 522 | 553 |

| September | 536 | 565 |

| October | 545 | 575 |

| November | 552 | 583 |

| December | 563 | 592 |

Revenue of Jio Financial is ₹134 crore in December 2023 which turned into ₹140 crore in March 2024. Profit before tax in December 2023 was ₹97 crore which turned into ₹104 crore in March 2024.

Also Read: Wipro Share Price Target

Jio Financial Share Price Target 2040

| Year | Jio Financial Share Price Target 2040 |

| 1st Price Target | 2,180 |

| 2nd Price Target | 2,250 |

Net profit is also increased to ₹77 crore in March 2024 which was ₹70 crore in December 2023. Analysts are predicting the Jio Financial share price target for 2040 between ₹2180 to ₹2250.

Jio Financial Services Ltd. Share Price Chart

Jio Finance Profit & Loss Account

| Fiscal Period | 2023 | 2022 |

|---|---|---|

| Period End Date | Mar 23 | Mar 22 |

| Revenue | 705.71 | 128.21 |

| Total Revenue | 705.71 | 128.21 |

| Cost of Revenue Total | 437.60 | 89.65 |

| Gross Profit | 268.11 | 38.57 |

| Selling/ General/ Admin Expenses Total | 75.08 | 21.70 |

| Depreciation/ Amortization | 51.00 | 6.34 |

| Unusual Expense( Income) | 10.72 | 0.51 |

| Other Operating Expenses Total | 30.47 | 2.57 |

| Total Operating Expense | 604.87 | 120.76 |

| Operating Income | 100.84 | 7.46 |

| Interest Inc( Exp) Net- Non- Op Total | -251.91 | -8.61 |

| Gain( Loss)on Sale of Assets | -1.05 | -5.66 |

| Other Net | 0.07 | 0.00 |

| Net Income Before Taxes | 75.61 | 6.03 |

| Provisionfor Income Taxes | 16.82 | 2.17 |

| Net Income After Taxes | 58.79 | 3.86 |

| Minority Interest | -1.23 | -0.79 |

| Net Income Before Extra Items | 57.56 | 3.07 |

| Net Income | 57.56 | 3.07 |

| Income Availableto Com Excl Extra Ord | 57.56 | 3.07 |

| Income Availableto Com Incl Extra Ord | 57.56 | 3.07 |

| Diluted Net Income | 57.56 | 3.07 |

| Diluted Weighted Average Shares | 24.57 | 24.57 |

| Diluted EPS Excluding Extra Ord Items | 2.34 | 0.12 |

| DPS- Common Stock Primary Issue | 0.50 | – |

| Diluted Normalized EPS | 2.69 | 0.15 |

Jio Finance Assets & Liabilities

| Particulars | 2023 |

|---|---|

| Total Assets | 114930 |

| – Current Assets | 6551 |

| – Non-current Assets | 108378 |

| Liabilities | 809.23 |

| – Current Liabilities | 802.61 |

| – Non-current Liabilities | 6.62 |

• Total assets of the company are ₹114929 crore in which current assets are ₹6551 crore & non-current assets are ₹108378 crore.

• Total liabilities of Jio Financial are ₹809 crore in which current liabilities are ₹802 crore & non-current liabilities are ₹6 crore.

• Cash flow from operating activities is ₹2054 crore but cash flow from the Investing & Financing activities is negative, as ₹-1103 crore & ₹-888 crore respectively.

• Net change in cash is ₹62 crore & closing cash balance is ₹63 crore.

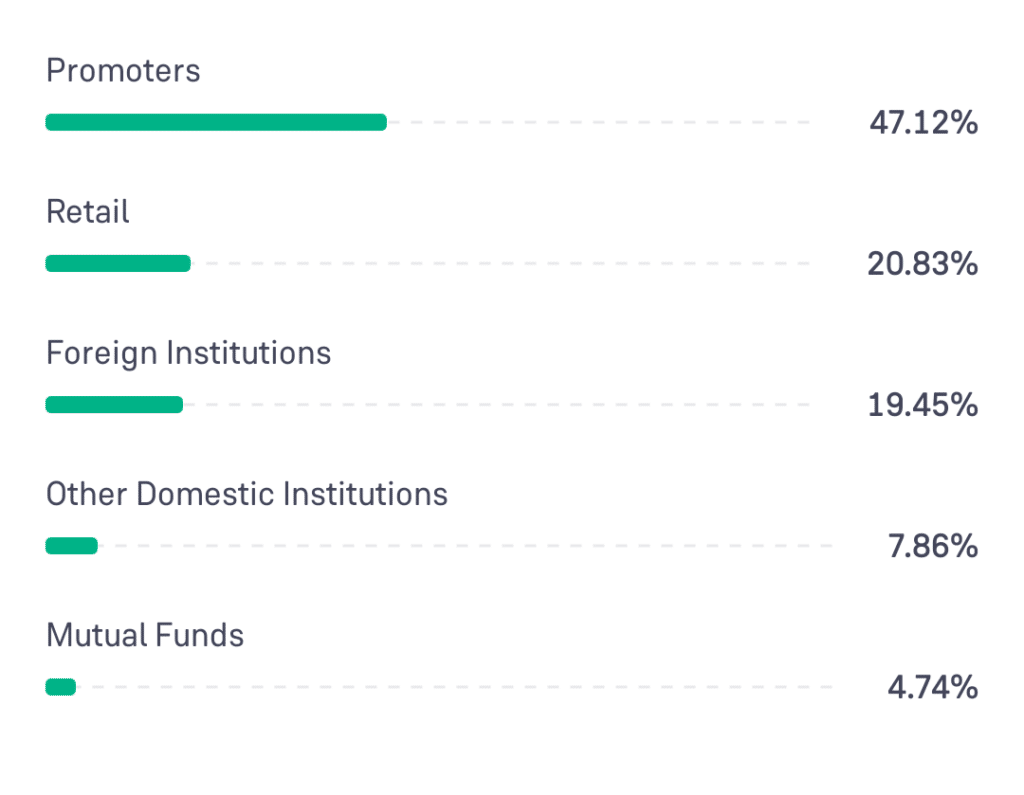

Jio Financial Company Ltd. Shareholding Pattern

Advantages Of Investing In Jio Finance

• The company is debt-free.

• It is profitable and have potential to grow more.

Disadvantages Of Investing In Jio Finance

• ROE (Return On Equity) is not good (4.50%).

• PAT margin is also not good.

Conclusion

Jio Financial Services Ltd. is a good company for investment. If we consider the profitability & strengths of this company then it have potential to grow more, thus it can generate good returns but exceptions are there i.e. market conditions may affect it’s share price. It is advised to consult with a financial advisor or do your deep research before investing in stock market.

FAQs

• What is the Jio Financial Share Price Target for 2024?

Jio Financial Share Price Target for the year 2024 is ₹305 to ₹398.

• What is the Jio Financial Share Price Target for 2025?

Jio Financial Share Price Target for the year 2025 is ₹345 to ₹415.

• What is the Jio Financial Share Price Target for 2027?

Share Price Target for the year 2027 is ₹415 to ₹445.

• What is the Jio Financial Share Price Target for 2030?

Share Price Target for the year 2030 is ₹454 to ₹592.

• What is the Jio Financial Share Price Target for 2040?

Share Price Target for the year 2040 is ₹2180 to ₹2250.

• Who is the CEO of Jio Financial Services Ltd.?

Mr. Hitesh Kumar Sethia is the CEO.

Also Read: Titan Share Price Target

Disclaimer: We are not SEBI-registered. The information given here is only for educational purposes. Share market is risky, so please research before investing.