ICICIdirect was established in 2000 and it is built on the solid foundation of the ICICI group. ICICIdirect offers various range of investment.

ICICI Direct provides access to trade shares on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). You can also participate in the initial public offerings (IPOs) of promising companies.

Moreover, ICICIdirect offers various educational resources, including research reports, webinars and in-depth articles.

With ICICIdirect, you can browse through a variety of options like stocks, mutual funds and IPOs. You can monitor your portfolio in real-time.

Key Features Of ICICIdirect

• Buy & sell stocks, investment in mutual funds.

• Participation in IPOs.

• Robust security measures.

• User-friendly mobile app and web platform.

• Comprehensive research reports, educational resources and webinars.

ICICIdirect Account Types:

• 3-in-1 Account: This is the most popular option, combination of trading account, demat account and savings account into one.

• 2-in-1 Account: This account is combination of demat and a trading account. Customers can use their non-ICICI bank account with this account.

ICICIdirect Charges 2024

ICICIdirect Account Opening and Maintenance Charges

Account opening with ICICIdirect is completely free and annual maintenance charges (AMC) are Rs. 700 per year but free for ICICIdirect customers for first year.

| Types of Charges | Charges |

| Demat account opening charges | Nil |

| Demat account annual maintenance charges (AMC) | Rs. 700 (free for ICICIdirect customers for the first year) Rs. 300 for ICICIdirect Neo customers from first year onwards. |

ICICIdirect Brokerage Charges

Customer pays brokerage charges while buying or selling the stocks through ICICIdirect. Following are the brokerage charges

• ICICIdirect Neo Plan

With Neo plan you can trade for Rs. 20 per Order and other charges are explained below:

| Trading Segment | Brokerage Charges |

|---|---|

| Equity Delivery | 0.55% |

| Equity Intraday | Rs 20 per executed order |

| Equity Future | Rs 0 (Free) |

| Equity Options | Rs 20 per executed order |

| Currency F&O | Rs 20 per executed order |

| Commodity F&O | Rs 20 per executed order |

| NCDs / Bonds | 0.75% |

• ICICIdirect Prime Plan

| Plan | Equity Cash | Equity Futures | Equity Options | Currency F&O | Commodity Futures |

|---|---|---|---|---|---|

| Rs 299 | 0.27% | 0.027% | Rs 40/lot | Rs 20/order | Rs 20/order |

| Rs 999 | 0.22% | 0.022% | Rs 35/lot | Rs 20/order | Rs 20/order |

| Rs 1,999 | 0.18% | 0.018% | Rs 25/lot | Rs 20/order | Rs 20/order |

| Rs 2,999 | 0.15% | 0.015% | Rs 20/lot | Rs 20/order | Rs 20/order |

• ICICIdirect I-Secure Plan

| Segment | Brokerage |

|---|---|

| Equity Delivery | 0.55% |

| Equity Intraday | 0.275% |

| Equity Future | 0.05% |

| Equity Options | Rs 95 per order |

| Currency F&O | Rs 20 per executed order |

| Commodity F&O | Rs 20 per executed order |

| NCDs / Bonds | 0.75% |

ICICIdirect Demat Account Charges

Trading or demat account opening on ICICIdirect is completely free but you have to pay (AMC) annual maintenance charges from 2nd year. Other demat account charges are explained below:

| ID | Transaction | Charges |

|---|---|---|

| 1 | Demat Account Opening Charges | Rs 0 (Free) |

| 2 | Transaction Charges (Sell) | For Normal Market & Off Market sell (0.04% of trans value for each CID)(subject to minimum ₹30) For Debt instruments Market & Off Market sell (0.04% of trans value for each CID)(subject to minimum ₹30 & maximum ₹25,000 ) |

| 3 | Demat + Courier charges | ₹50 Per Demat Request Form and ₹10 For Each Certificates |

| 4 | Remat | ₹25 + CDSL charges at actual |

| 5 | Pledge Creation | 0.02% or minimum of ₹35 |

| 6 | Pledge Creation Confirmation | 0.02% or minimum of ₹35 |

| 7 | Pledge Invocation | 0.02% or minimum of ₹35 |

| 8 | Other Charges | ₹200 for restoring services if account is suspended for non payment of charges. |

ICICIdirect Transaction Charges

Transaction charges are combination of Exchange Turnover Charge and Trade Clearing Charge. Transaction charges of ICICIdirect are written below:

| Segment | Transaction Fee |

|---|---|

| Equity Delivery | NSE Rs 325 per Cr (0.00325%) | BSE Rs 375 per Cr (0.00375%) (each side) |

| Equity Intraday | NSE Rs 325 per Cr (0.00325%) | BSE Rs 375 per Cr (0.00375%) (sell side) |

| Equity Futures | NSE Rs 190 per Cr (0.0019%) | BSE Rs 0 |

| Equity Options | NSE Rs 5000 per Cr (0.05%) | BSE Rs 3700 per Cr (0.037%) (on premium) |

| Currency Futures | NSE Rs 90 per Cr (0.0009%) | BSE Rs 90 per Cr (0.0009%) |

| Currency Options | NSE Rs 4000 per Cr (0.04%) | BSE Rs 100 per Cr (0.001%) (on premium) |

| Commodity | Group A – Rs 260 per Cr (0.0026%) |

ICICIdirect Trading Taxes

ICICIdirect also charges government fees and taxes. The below table can be used to know the charges.

| Tax ICICIdirect | Rates |

|---|---|

| Securities Transaction Tax (STT) | Equity Delivery: 0.1% on both Buy and Sell Equity Intraday: 0.025% on the Sell Side Equity Futures: 0.01% on Sell Side Equity Options: 0.05% on Sell Side(on Premium) Commodity Futures: 0.01% on sell side (Non-Agri) Commodity Options: 0.05% on sell side Currency F&O: No STT On Exercise transaction: 0.125% Right to entitlement: 0.05% on sell side |

| GST | 18% on (Brokerage + Transaction Charge + SEBI Fee) |

| SEBI Charges | 0.0001% (₹10/Crore) of the turnover (except for Agri futures where it is Rs 1 per crore) |

| Stamp Duty | (On buy side only) Delivery: 0.015%, Intraday: 0.003%, Equity Futures: 0.002%, Equity Options: 0.003%, and Currency F&O: 0.0001%.Commodity Futures: 0.002%, Commodity Options: 0.003% (MCX) |

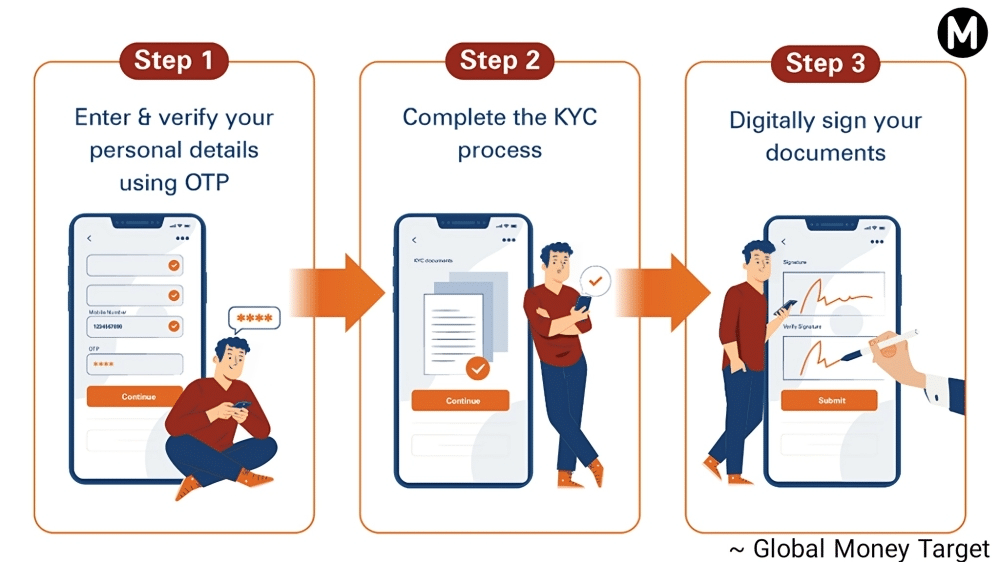

ICICIdirect Account Opening Process

Opening account in ICICIdirect is simple. Follow these steps to open account with ICICIdirect:

Online Process

• Visit ICICIdirect website: https://www.icicidirect.com/

• Fill mobile number & email and then verify it.

• Submit your documents.

After verification, your account will be activated. This process is quite simple and hassle-free.

Visit ICICI Branch

You can also visit your nearest ICICI Branch to open an account.

Also Read: Groww App Review 2024: Brokerage Charges, Trading, Demat Account

ICICIdirect Pros and Cons

Pros

Reputable Brand: ICICIdirect is backed by the ICICI Group, offers a sense of security and stability.

Variety of Investment Options: You can invest in stocks, mutual funds, IPOs, bonds, and even options.

User-Friendly Platform: ICICIdirect mobile app and web platform make investing convenient and accessible.

Educational Resources: ICICI Direct offers various research reports, webinars, and articles, fostering informed decision-making.

3-in-1 Account: This is a combination of trading account, demat account and savings account.

Margin Trading: For experienced investors, margin trading allows for potentially higher returns (and risks) by leveraging borrowed funds.

Portfolio Management Services (PMS): High-net-worth individuals can get benefit from personalized investment management through dedicated portfolio managers.

Cons

High Brokerage Charges: Their brokerage fees might be higher compared to some discount brokers.

Limited Free Mutual Fund Investment: Unlike some competitors, ICICI Direct might charge fees for mutual fund transactions.

Focus on Indian Markets: If your investment goals are beyond the Indian market, ICICI Direct might not be the most suitable platform.

FAQs

What is ICICIdirect?

ICICI Direct is a one of the leading Indian brokerage firm. You can invest in variety of options like stocks, mutual funds and IPOs.

Is ICICIdirect App Free?

The ICICI Direct app itself is free to download from the App Store or Google Play. However, using the app for trading activities will incur charges. These charges can vary depending on the type of investment and your trading volume.

Is ICICIdirect App Safe?

Yes, ICICIdirect app is safe. ICICI Direct prioritizes security. They implement robust security measures to safeguard your financial information. However, as with any online platform, it’s important to practice safe habits like using strong passwords and being cautious about suspicious activity.

ICICI Direct Brokerage Charges?

ICICI Direct’s brokerage charges can vary depending on your trading activity and the plan you choose. Refer the above tables for detailed information.

ICICI Direct mobile login?

There are two main ways to access your ICICI Direct account through their mobile app:

Existing User Login: If you already have an account:

• Open the ICICI Direct app.

• Enter your registered User ID and Password.

• You might have an option to enable fingerprint or face recognition for future logins (subject to your device and app settings).

New User Login (if you have an account but haven’t used the app):

• Open the ICICI Direct app.

• Locate the “New User” or “Login” section.

• You might need to enter your registered mobile number or User ID to initiate the login process.

How to trade in ICICI Direct App?

Follow these steps to trade on the ICICI Direct app:

• Login: Open the app and log in using your User ID and Password (or MPIN if set up).

• Search & Select: Search for the stock, mutual fund, or IPO you wish to trade by using the search bar or browsing categories.

• Order Details: Once you’ve selected your investment, choose the “Buy” or “Sell” option. Enter the desired quantity and set the order type (e.g., market order, limit order).

• Review & Confirm: Carefully review the order details, including price, quantity, and total value. Double-check everything before confirming the order.

• Order Execution: Once confirmed, your order will be sent to the exchange for execution. You’ll receive a notification about the order status within the app.

Features of ICICIdirect

Following are the features of using ICICIdirect:

• Buy & sell stocks, mutual funds, IPOs directly from your phone.

• Monitor portfolio performance & track live markets.

• Access research reports, charts & news for informed decisions.

• Place, modify & track investment orders with easy way.

• Explore various investment options like stocks & mutual funds.

• Manage trading, demat & savings accounts (if linked) conveniently.

• Secure login with fingerprint or face recognition (subject to device & app settings).

How to pay ICICI Direct AMC charges?

ICICI Direct might automatically deduct the AMC charges from your linked savings account if you have a 3-in-1 account. If not, they might send you a bill or notification for payment. You can typically make the payment through various methods like online banking, NEFT, or RTGS using your registered bank account.

Is ICICI Direct good for trading?

Yes, ICICIdirect is good for trading for those investors, who are seeking a user-friendly platform with a variety of investment options (stocks, mutual funds, IPOs). ICICIdirect also offers educational resources and a 3-in-1 account for convenient management.

How to close ICICIdirect account online?

Follow these steps to close ICICIdirect account:

Download Closure Form: Visit the ICICI Direct website and download demat account closure form.

Fill and Sign the Form: Provide all the necessary details on the form, including your account information, reason for closure, and signature.

Prepare Documents: Gather the required documents, which might include a copy of your PAN card, ID proof or address proof.

Submit: Once you’ve completed the form, submit them in your nearest ICICI Direct branch or by courier to their designated address.

Additional Tips:

Ensure that you have no outstanding dues or pending trades before initiating the closure process.

Contact ICICI Direct customer support for any clarifications or assistance regarding the required documents or submission process.

What is BTST order in ICICIdirect?

BTST stands for “Buy Today Sell Tomorrow” in ICICI Direct. It’s a facility that allows you to sell stocks you purchase on the same day before they are credited to your demat account.

ICICI Direct Customer Care Number

ICICIdirect Customer Care Number is: 1860 123 1122