In this article, we will discuss the HDFC Bank Share Price Target 2024, 2025, 2026 to 2030. But before that let’s know about HDFC BANK.

About HDFC BANK

HDFC bank is one of the leading & largest private sector bank by assets in India. HDFC bank was originated as a subsidiary of the Housing Development Finance Corporation (HDFC), a leading provider of housing finance in India.

HDFC bank was incorporated in 1994 and founded by Hansmukhbhai Parekh.

Vision, Mission And Values

HDFC Bank’s mission is to be a world class Indian bank. We have a two-fold objective: first, to be the preferred provider of banking services for target retail and wholesale customer segments. The second objective is to achieve healthy growth in profitability, consistent with the bank’s risk appetite.

The bank is committed to maintaining the highest level of ethical standards, professional integrity, corporate governance and regulatory compliance. HDFC Bank’s business philosophy is based on five core values: Operational Excellence, Customer Focus, Product Leadership, People and Sustainability. Source: HDFC Bank

Company Profile

| Traded as | NSE: HDFCBANK BSE: 500180 NYSE: HDB (ADS) |

| ISIN | INE040A01034 |

| Founded | August 1994 |

| Headquarters | Mumbai, Maharashtra, India |

| CEO | Sashidhar Jagdishan |

| Subsidiaries | HDFC Life HDFC ERGO HDFC Securities HDFC Mutual Fund HDB Financial Services HDFC Asset Management Company HDFC Credila Financial Services |

| Website | www.hdfcbank.com |

HDFC Bank Ltd. Fundamentals

| Market Cap (Cr) | 11,33,612 cr |

| P/E | 17.68 |

| P/B | 2.51 |

| Face Value | 1 |

| Div. Yield % | 1.30% |

| Book Value (TTM) | 597.88 |

| Promoter Holding % | 0 |

| EPS (TTM) | 84.17 |

| ROE % | 14.15% |

HDFC Bank is known for its innovative banking solutions. It was the first bank in India to launch an International Debit Card, MobileBanking, and 24×7 PhoneBanking. Source: facts.net

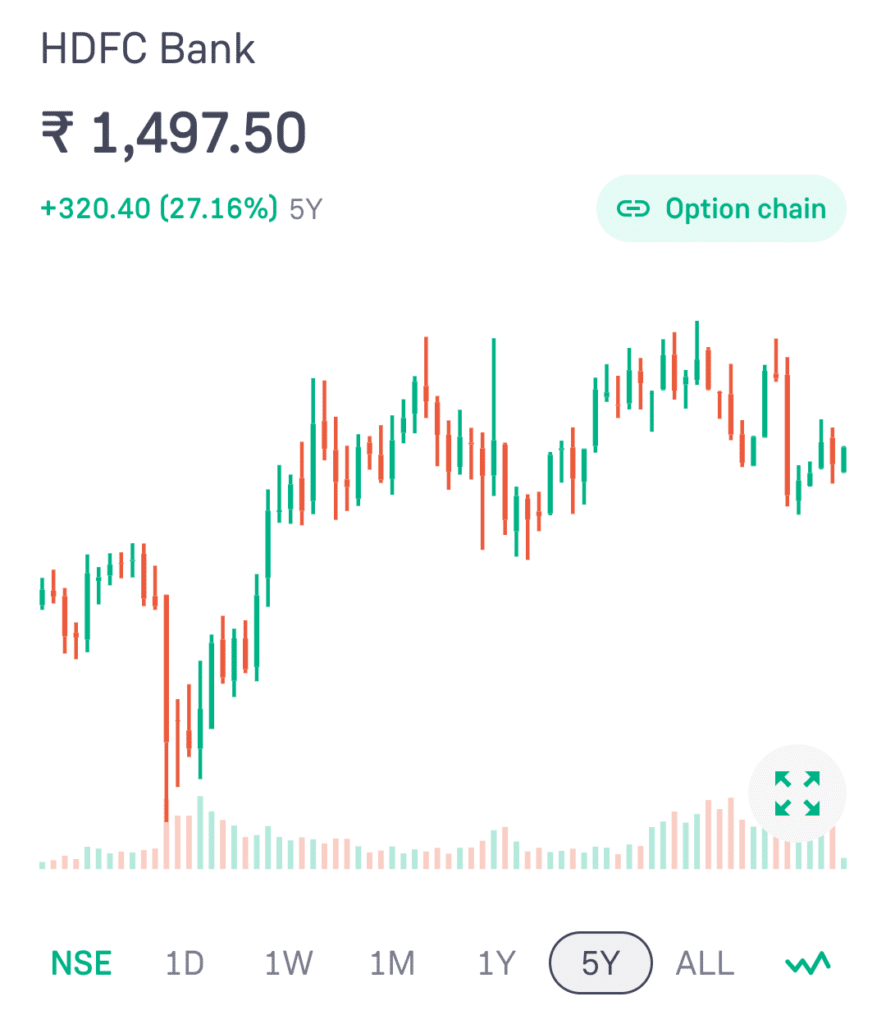

HDFC Bank Ltd. Share Price Chart

HDFC Bank Share Price Target (2024)

| Month (2024) | Maximum Target | MinimumTarget |

| January | Rs – | Rs – |

| February | Rs 1,843.09 | Rs 1,602.57 |

| March | Rs 1,882.20 | Rs 1,661.95 |

| April | Rs 2,029.27 | Rs 1,945.59 |

| May | Rs 2,107.72 | Rs 1,621.33 |

| June | Rs 2,229.27 | Rs 1,945.59 |

| July | Rs 2,149.88 | Rs 1,666.57 |

| August | Rs 2,364.87 | Rs 1,876.88 |

| September | Rs 2,483.11 | Rs 1,910.08 |

| October | Rs 2,721.31 | Rs 2,247.16 |

| November | Rs 2,967.37 | Rs 2,359.52 |

| December | Rs 3,128.72 | Rs 2,406.71 |

As per our analysis, HDFC bank share price target for 2024 is expected to be between ₹1,602.57 to ₹3,128.72.

HDFC Bank Share Price Target (2025)

| Month (2025) | Maximum Target | MinimumTarget |

| January | Rs 3,191.29 | Rs 2,454.84 |

| February | Rs 3,359.26 | Rs 2,584.04 |

| March | Rs 3,527.22 | Rs 2,713.24 |

| April | Rs 3,149.30 | Rs 2,422.54 |

| May | Rs 2,863.00 | Rs 2,202.31 |

| June | Rs 3,149.30 | Rs 2,422.54 |

| July | Rs 2,999.34 | Rs 2,307.18 |

| August | Rs 3,124.31 | Rs 2,403.31 |

| September | Rs 3,280.52 | Rs 2,523.48 |

| October | Rs 3,477.35 | Rs 2674.89 |

| November | Rs 3,720.77 | Rs 2,862.13 |

| December | Rs 3,795.18 | Rs 2,919.37 |

Analysts are projecting HDFC bank share price target for 2025 between ₹2454.84 to ₹3795.18 but only if they maintained their current growth. Keep this in mind that market conditions can affect it’s share price.

HDFC Bank Share Price Target (2026 to 2030)

| Year | Maximum target | Minimum Target |

| 2026 | Rs 2,656.63 | Rs 1,859.64 |

| 2027 | Rs 2,258.13 | Rs 1,580.69 |

| 2028 | Rs 4,064.64 | Rs 2,845.25 |

| 2029 | Rs 8,349.41 | Rs 5,844.58 |

| 2030 | Rs 9,298.20 | Rs 6,508.74 |

Experts are projecting HDFC bank share price target from 2026 to 2030, ranging from ₹1,859.64 to ₹9,298.20.

HDFC Bank Profit And Loss

| Fiscal Period | 2024 | 2023 |

|---|---|---|

| Interest Income Bank | 2,83,649.02 | 1,70,754.05 |

| Total Interest Expense | 1,54,138.55 | 77,779.94 |

| Net Interest Income | 1,29,510.47 | 92,974.11 |

| Loan Loss Provision | 25,018.28 | 13,558.03 |

| Net Interest Inc After Loan Loss Prov | 1,04,492.19 | 79,416.08 |

| Non- Interest Income Bank | 1,24,345.75 | 33,912.05 |

| Non- Interest Expense Bank | -1,52,269.34 | -51,829.74 |

| Net Income Before Taxes | 76,568.60 | 61,498.39 |

| Provisionfor Income Taxes | 11,122.10 | 15,349.69 |

| Net Income After Taxes | 65,446.50 | 46,148.70 |

| Minority Interest | -1,384.46 | -151.59 |

| Net Income Before Extra Items | 64,062.04 | 45,997.11 |

| Net Income | 64,062.04 | 45,997.11 |

| Income Availableto Com Excl Extra Ord | 64,062.04 | 45,997.11 |

| Income Availableto Com Incl Extra Ord | 64,062.04 | 45,997.11 |

| Diluted Net Income | 64,062.04 | 45,997.11 |

| Diluted Weighted Average Shares | 711.72 | 559.12 |

| Diluted EPS Excluding Extra Ord Items | 90.01 | 82.27 |

| DPS- Common Stock Primary Issue | 19.50 | 19.00 |

| Diluted Normalized EPS | 90.01 | 82.15 |

HDFC Bank has a presence in several countries, including Bahrain, Hong Kong, Dubai, and the United States, offering a wide range of banking services to NRIs. Source: facts.net

HDFC Bank Financials

| Particulars | 2023 | 2022 |

| Total Assets | 25,30,432 | 21,22,934 |

| – Current Assets | 2,21,711 | 1,73,737 |

| – Non-current Assets | 25,30,432 | 21,22,934 |

| Total Liabilities | 22,40,134 | 18,74,887 |

| – Current Liabilities | 18,89,915 | 15,64,794 |

| – Non-current Liabilities | 3,50,219 | 3,10,093 |

| Revenue | 2,04,666 | 1,67,695 |

| Expenses | 1,43,167 | 1,16,822 |

| EBITA | 63,843 | 52,554 |

| Profit Before Tax | 61,498 | 50,873 |

| Net Profit | 46,148 | 38,150 |

| Cash flow from operating activities | 20,813 | -11,959 |

| Cash flow from financing activities | 23,940 | 48,124 |

| Cash flow from investing activities | -2992 | -2051 |

• Assets: Total assets of HDFC bank are ₹25,30,432 crore in 2023 which were ₹21,22,934 crore in 2022.

• Liabilities: Total liabilities in 2022 were ₹18,74,887 crore, which turned into ₹22,20,134 in 2023, in which current liabilities are ₹18,89,915 crore and non-current liabilities are ₹3,50,219 crore.

• If we look at the revenue then it is also increased to ₹2,04,666 crore in 2023, which is a positive indicator.

• Expenses have also been increased to ₹1,43,167 crore in 2023 which were ₹1,16,822 crore in 2022.

• If we talk about profits, then EBITA in 2023 is ₹63,843 crore, EBIT is ₹61,498 crore, Profit Before Tax is ₹61,498 crore and net profit is ₹46,148 crore.

• Cash flow from operating activities is ₹20,813 crore and cash flow from financing activities is ₹23,940 crore but cash flow from investing activities is negative ₹-2992 crore.

• Closing cash balance is ₹1,97,147 crore & net change in cash is ₹41,762 crore.

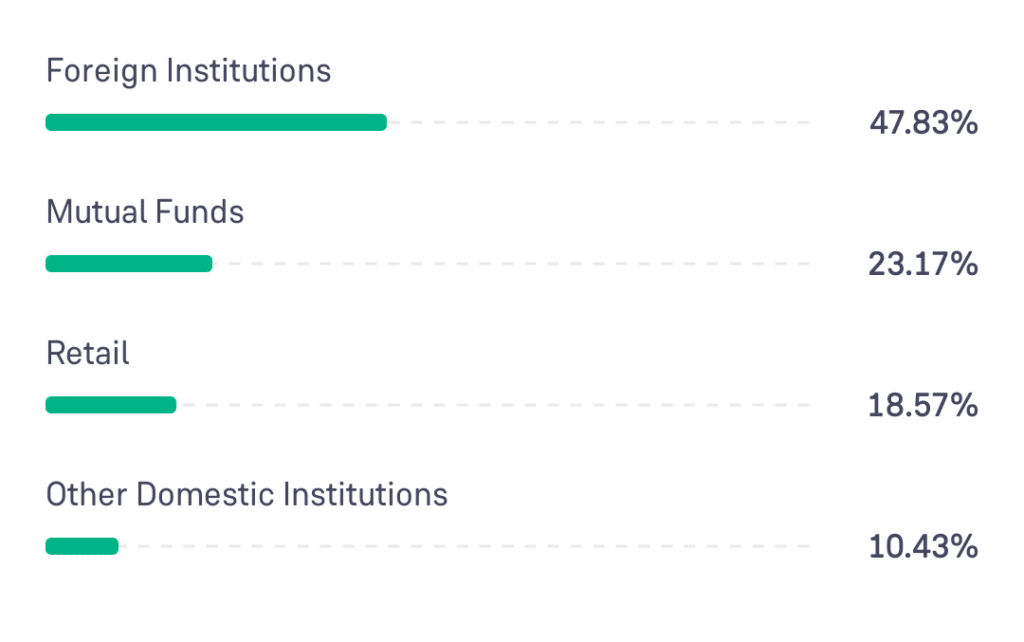

HDFC Bank Ltd. Shareholding Pattern

Advantages Of Investing In HDFC Bank

• ROA (Return On Assets) is 1.92%, which is a positive indicator.

• ROE (Return On Equity) is 16.77%.

• Net interest margin (NIM) is also increased in past years.

• HDFC Bank is profitable in past years.

Disadvantages Of Investing In HDFC Bank

• High amount of debt.

• Operating income is declining.

Conclusion

HDFC Bank is performing well. As per our experts, HDFC bank’s share price may reach at very higher position but only if they maintained their current position. But always keep this in mind that market conditions can affect it’s share price target, so please make sure that you consult a financial advisor or share market expert before investing in stock market.

FAQs

• Who is the CEO of HDFC Bank?

Mr Sashidhar Jagdishan is the CEO of HDFC Bank.

• What is the full form of HDFC Bank?

Housing Development Finance Corporation is the full form of HDFC Bank.

• What is the HDFC Bank Share Price Target 2024?

HDFC bank share price target for 2024 is expected to be between ₹1,602.57 to ₹3,128.72.

• What is the HDFC Bank Share Price Target 2025?

HDFC bank share price target for 2025 is expected to be between ₹2454.84 to ₹3795.18.

• What is the HDFC Bank Share Price Target 2027?

Analysts are projecting HDFC Bank share price target for 2027 between ₹1580.69 to ₹2258.13.

• What is the HDFC Bank Share Price Target 2030?

HDFC Bank Share Price Target for 2030 is expected to be between ₹9,298.20 to ₹6,508.74.

Also Read : JIO Financial Share Price Target

Disclaimer: We are not SEBI-registered. The information given here is only for educational purposes. Share market is risky, so please research before investing.